What is your income model? How to optimize it?

Income is a key factor in your individual finance. However, when compared to other factors like savings or investment, incomes are frequently undervalued. I'd like to ask you a few questions:

Where are your sources of income?

Is your income fixed or unfixed?

Which factors have an impact on earnings?

What is your income's tendency? Increasing or decreasing or remaining unchanged?

These basic questions will give you a deeper view of your income model. If you find it unclear to answer them, let me walk you through this article!

Note: This article is translated from the source:

1. What are the origins of your income?

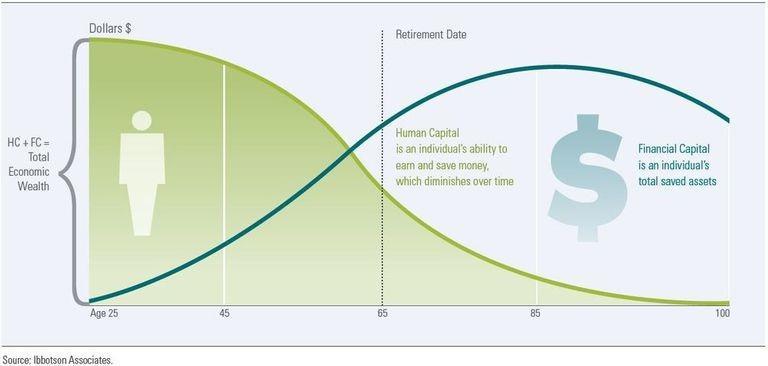

People's income is derived mostly from two main sources: human capital and financial capital.

The most basic income model is human capital. Your human capital is made up of your knowledge, skills, and qualifications. All of the earnings that you are attempting as a result of your capability.

For example, suppose you are a fresher who is paid a salary of 12 million VND for your level and experience. Apart from your full-time job, your freelance business allows you to earn an additional 3 million VND every month. As a result, your total income is 15 million VND, which is entirely made up of human capital.

However, since your capabilities are limited. None of us can work over 24 hours per day, no matter how hard we try. The appearance of passive income is that money makes money. Financial capital is the value of an asset that has grown over time.

Financial capital can be easily understood as the total worth of your assets minus your debts. Assume you have accumulated 1 billion VND after years of effort and have deposited it in a savings account with a 6% annual interest rate. Every month, you will obtain 5 million VND in return for this balance. Needless to say, aside from your regular paycheck, you can make more money by doing nothing.

Here is a graph illustrating the relationship between human and financial capital. Human capital has reduced over your life span as a result of productivity and age. Financial capital, on the other hand, may be slow when you are young, but it will increase significantly if you care for it.

So, how can we optimize both financial and human capital as quickly as possible?

2. What is the capital model that you use?

In the early of youth, your income mostly comes from your work. Each person, on the other hand, has their own model. Therefore, the income model might be split into four cases:

Sideways income

This group's earnings have not fluctuated significantly over their careers. Typically, they work in governance. Nevertheless, despite the fact that their experience grows over time, their speed is generally slow, and they have a well-defined plan.

Flexible incomes

Monthly earnings vary depending on the amount of work they do or the productivity they attain. A salesperson, for example, will be paid based on the revenue made by their own company.

Decreased income

This is a group of people who make a lot of money at the top of their career path. They work as artists, football players, or singers. They quickly rise to fame after captivating a large audience. However, due to the next generation of skill, the star's brightness diminishes quickly.

Increased earnings

The further they work, the more income they earn. Over time, they add more and more value to society. Many enterprises are willing to pay for their expertise.

So, now that you know about four models, how do you maximize your income model?

After defining which group you belong to, you must make a strategy to maximize it. There is no one model that is superior to the others. The main thing is that you have a clear understanding of which group you belonged to, and then concentrate your experience to earn money at the peak of your career?

For example, if you are in decreased income, you are aware that the early stages of your job might provide you with the most valuable potential. As a result, you must focus on making money and making an effort to accumulate as soon as possible.

On the other hand, if your income is increased, you may not expect to make a lot of money at the beginning of your career. You realize that this is an ideal time to acquire as many skills and knowledge as possible, preparing for a later breakout.

3. Start accumulating financial capital as soon as possible

As mentioned above, incomes from labors are limited. In the meantime, passive income from human capital might bring you to aim to the financial target of your life.

Coming back to the previous section's example, after 20 years of work, your passive income can reach a monthly interest of 10 million VND, which is sufficient to allow you to decide whether or not to continue working. In other words, it is called "financial freedom".

Some assets that can bring you passive income such as: dividends, bonds, stock, gold, Bitcoin,... Your target is to choose a suitable asset that you really have knowledge about it. Remember financial capital is not for everyone, but for those who are aware of investing and accumulating. Otherwise, you must make a living base on your own labor, and maybe take risks at the end stage of your life.